What Is The Average Directional Index (Adx)?

Di: Luke

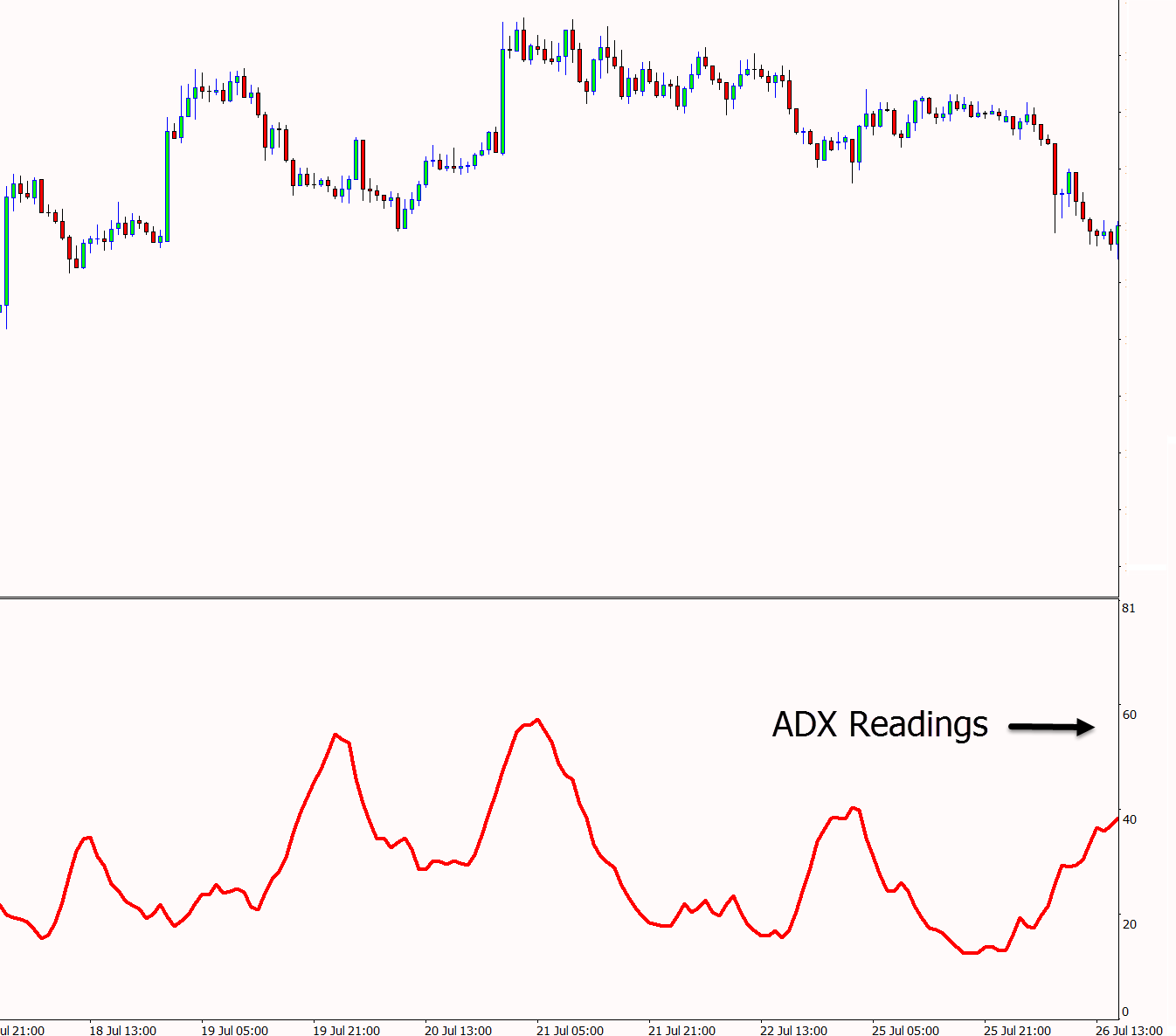

According to Wilder, the trend has strength . ADX is a momentum oscillator which can offer insights into whether an asset is trending and if so how significantly.

Average Directional Index (ADX) Explained Simply In 3 Minutes

Unlike other trend indicators the ADX is non-directional, meaning it simply register the strength of the trend, not whether it is an up-trend or a down-trend.

What Is An Average Directional Index (ADX)?

All About The ADX Indicator (Average Directional Index)The ADX indicator is explained simply in this casual and informative 3 minute training video which wil.

Average Directional Index (ADX)

ADX, which stands for Average Directional Index, is a trading indicator that’s used to measure the overall strength of trends in the market. Its values oscillate between 0 to 100, higher the value higher is the strength of trend.tradingsetupsreview.The Average Directional Index, or ADX, is a trend indicator that is used to quantify the strength of a trend.Average Directional Index : Trading Tips.This Indicator calculates the Average Directional Index (ADX), a popular indicator used to quantify the strength of a trend. ADX is calculated based on the .The average directional index (ADX) holds pivotal importance as an instrument for traders analyzing market trend momentum. The scale goes from 0 to 100. An ADX reading above 25 signals that a strong trend is in place. The default look-back period off ADX to calculate trend strength is 14 periods, but various other periods are used depending on the relative volatility of stock or .

Der ADX Indikator: Trading, Einstellungen & Berechnung

This line registers a trend’s strength but it doesn’t show its direction.ADX stands for Average Directional Movement Index and can be used to help measure the overall strength of a trend. Welles Wilder developed the Average Directional Index (ADX) indicator, which measures trend strength and shows trend direction.Der Average Directional Index (ADX) hilft Tradern, die Stärke eines Trends zu bestimmen, nicht seine tatsächliche Richtung.Average Direction Index also known as ADX is a non-directional trend strength indicator. Er ist verwandt mit dem Directional Movement Index (DMI) und tatsächlich hat letzterer die ADX-Zeile enthalten. Welles Wilder, the Average Directional Index .

How to Use ADX for Swing Trading

How To Read ADX Indicator? – An Easy And Simple .

Average Directional Index (ADX) [ChartSchool]

It’s important to emphasize that while ADX measures the strength of .

Calculating the ADX. It is not only useful for identifying trends but also for determining when to enter or exit a trade. Average directional index (ADX) is a short-term chart indicator.The ADX or Average Directional Index is a technical indicator used to measure the overall strength of a trend.

How to Use ADX (Average Directional Index) in Forex

How to Trade With the Directional Movement Index (DMI)

This is the formula you’ll use when you calculate the ADX for the very first time. Although initially it was meant for the commodity market, nowadays it is efficiently used with other types of .The average directional index is a tool used in technical analysis to determine market trends. It quantifies price action, allowing traders to see whether a particular move falls within a trending or non-trending .

So, while the -DI and +DI help highlight direction, investors use ADX to gauge how strong that uptrend or downtrend is. Let’s take a 20-period ADX as an example. Here’s a few tips that can help you when swing trading with this indicator: Do not be impatient and enter too early: the ADX must break out and hold above 40 on the day prior to entering your position. ADX fluctuates from 0 to 100 , with readings below 20 indicating a weak trend and readings . This can also be called as a trend gauging indicator.

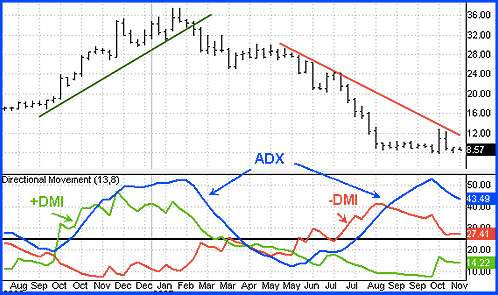

Average Directional Movement Index

The Average Directional Index (ADX) is a specific indicator used by technical analysts and traders in order to determine the strength of a trend.comAverage Directional Movement Index, ADX – MQL5mql5.What Is the Average Directional Index (ADX)? The Average Directional Index (ADX) is a technical indicator created by Welles Wilder to measure the trend . Therefore, an ADX indicator has three lines on the chart: DI+, DI-, and the ADX line.The Average Directional Index, or ADX for short, is another example of an oscillator. In this blog post, we will . During a downtrend, at the point where +DI and -DI cross each other, traders receive a sell signal in the market to trade along with the trend. If a market’s range increases over time, then the ADX will go up – if not, it will go down. The ADX provides valuable insights into the market, allowing traders to make informed .The Average Directional Index consists of the ADX line and two other directional indexes (+DI and -DI).The Average Directional Index, or ADX, is a tool for determining the comprehensive strength of a trend. The ADX is primarily used as an indicator of momentum, or trend strength, but the total ADX .A third line, the average directional index, or ADX, is nondirectional but shows movement strength. Obwohl es ursprünglich für den Rohstoffmarkt gedacht war, wird . A reading above 25 indicates a strong trend, whereas one below 25 indicates a weak trend.Average Directional Index (ADX): a smoothed average of the +DI and -DI values; it provides a single value that reflects the overall strength of the prevailing trend.

What Is the Average Directional Index (ADX)?

Many traders make use of it to spot the . 25-50 means that a market is strongly trending.

Algorithmic Trading with Average Directional Index in Python

ADX measures this strength . The average directional index or ADX indicator for short, as the name suggests is a directional index. ADXとは、Average Directional Indexの略で、ウェルズ・ワイルダーによって開発されたテクニカル指標です。 この指標はADX単体ではなく、+DI(Positive Directional Indicator)と-DI(Negative Directional Indicator)という2つの線と一緒に表示されます。ADX and DI (Average Directional Index) – CORRECT .Average Directional Index (ADX): Like we mentioned earlier, the ADX’s job is to tell how strong that investment’s price movement really is—whether it’s up or down. Der Average Directional Movement Index (ADX) ist ein Indikator der technischen Analyse und dient der Trendstärkebestimmung eines .The ADX is derived from two accompanying indicators: the Positive Directional Index (DI+) and the Negative Directional Index (DI-). Traders can also use the ADX to determine whether to make a . It is an invaluable part of many traders’ arsenal of tools, especially when paired with other Parabolic SAR or RSI indicators.

What Is ADX (Average Directional Index) and How to Use It?

The ADX indicator . Welles Wilder Jr. The ADX is calculated by multiplying the previous Directional Index value with 13 (lookback .comEmpfohlen basierend auf dem, was zu diesem Thema beliebt ist • Feedback

Average directional movement index

The Average Directional Index (ADX) is a popular technical analysis tool and a widely-used three-line indicator. It can be used to help you evaluate the market or an investment’s strength.The average directional index (ADX) is a technical indicator used in the financial markets to determine the strength of a trend. When the ADX dips below 20, there isn’t a trend, .Average Directional Index (ADX) ADX is a third line on the DMI, and it shows the strength of the trend.comEmpfohlen basierend auf dem, was zu diesem Thema beliebt ist • Feedback In other words, the ADX belongs to a group of indicators that show the general direction of the markets. Developed by J.How Average Directional Index ADX Works – Calculation The calculation of the Average Directional is rather complex.Der Average Directional Index (ADX) ist ein technischer Indikator, der von Welles Wilder entwickelt wurde, um die Trendstärke zu messen.The average directional index, or ADX, is the primary technical indicator among the five indicators that make up a technical trading system developed by J. However, like any other technical indicator, the ADX can’t provide . It’s often used as a .The Average Directional Index (ADX) is used to measure the strength or weakness of a trend, not the actual direction. Mit ihm lässt sich herausfinden, ob der Markt rangiert, oder ein neuen Trend auslöst.Average Directional Index(ADX)とは.The Average Directional Index (ADX) is a popular trading tool which can be readily applied to Bitcoin and crypto markets. The ADX indicator is an average of expanding price range .The Average Directional Index (ADX), developed by J. ADX is primarily used to quantify the strength of a trend. and is calculated using the other indicators that make up the trading system.The final step is to calculate the ADX itself by utilizing the determined Directional Index values.The Average Directional Movement Index formula is the average (mean) of a set of DX values across a specific period of time. Directional movement is defined by +DI and -DI. Below is a simplified calculation of the ADX: We determine the positive directional movement (+DMI) and the negative directional movement (- DMI) for each bar in the last 20 periods.The Average Directional Index (ADX) is a technical indicator created by Welles Wilder to measure the trend strength.Average Directional Movement Index.Average Directional Index (ADX) itself (thick brown line).ADX values range between 0 and 100, where high numbers imply a strong trend, and low numbers imply a weak trend. Minus Directional Movement Indicator (-DMI) (red line) is the difference between two . – Free download of the ‚Average Directional Movement Index, ADX‘ indicator by ‚MetaQuotes‘ for MetaTrader 4 in the MQL5 Code Base, 2005.

ADX Trading Strategy: DMI Indicator Day Trading Tips

com6 Top ADX Indicator Trading Strategies – Trading Setups . Uptrend and Downtrend Confirmation . The ADX line is then plotted on a chart from 1-100: 0-25 means that a market has a weak trend – or no trend whatsoever. Plus Directional Movement Indicator (+DMI) (green line) is the difference between two consecutive highs.The ADX indicator is a powerful tool that measures the strength of a trend and helps traders determine whether to enter or exit a position.

Its values range from 0 to 100. Additionally, it computes the Positive Directional Index (+DI) and Negative Directional Index (-DI), which measure the strength of upward and downward price movements respectively.Overview

ADX: The Trend Strength Indicator

The ADX indicator’s aims to help traders better understand if the market is trending and how strong this trend is.

The Complete Guide to Average Directional Index

Average Directional Movement Index Indicator (ADX) helps to determine if there is a price trend. There is a different formula used for each of the three indicators. Welles Wilder, the Average Directional Index (ADX) helps traders measure how strongly price is trending and whether its momentum is increasing or falling.ADX Indicator – Conclusion.The Average Directional Index, or ADX, is a technical analysis indicator that quantifies the strength of a market trend. Many traders make use of it to spot the buying/selling signals or periods when it’s better to hold the investment.

![Average Directional Index (ADX) [ChartSchool]](https://school.stockcharts.com/lib/exe/fetch.php?media=technical_indicators:average_directional_index_adx:adx-2-qqqqexam.png)

The ADX acts like a volatility indicator to let you know when price action is getting stronger over time.The average directional index (ADX) is one of the most complete indicators, and learning how to use it will surely benefit your trading strategy. It is plotted as a single line with a value between 0 and 100. It is based on the idea that trading, when the market is moving in the direction of a strong trend, increases the chances of profit and lowers the risk by a considerable margin. The ADX indicator is not something new. Thus, the formula to calculate ADX mathematically is as follows: ADX Indicator Formula = (DX1 + DX2 +.The average directional index works using a moving average of price range expansion. Welles Wilder created the Average Directional Index (ADX) as a core element of the Directional Movement System – incorporating positive and negative directional .The Average Directional Index (ADX) is a technical indicator used by traders to measure the strength and momentum of trends. When there is an uptrend, this crossover sends a buy signal to the traders. ADX is a momentum oscillator which can . The ADX is usually accompanied by two other indicators – the positive directional indicator (+DI) and the negative directional ., is a popular technical indicator used by traders to measure the strength of a trend. Viele Händler nutzen es, um die Kauf- oder Verkaufssignale und um Perioden zu erkennen, in denen es besser ist, die Investition zu halten. Welles Wilder, Jr. Welles Wilder invented the ADX indicator for daily commodity .

Average Directional Index (ADX) — TradingView

Operating on a set period, usually 14 days, it distills price movements into a single line that fluctuates between 0 and 100; stronger trend momentum is indicated by higher values. The ADX can help traders assess .

What sets this script apart is its .

- What Is The Application Rationalization Data Dictionary?

- What Is The Difference Between Kalimera And Kalinychta?

- What Is Schnitzel Made Of | What is Schnitzel? (+ Recipes!)

- What Is The Correct Usage Of Was Sent?

- What Is Southern Asia? : South Asia

- What Is Plasmacytoma? | Plasmacytoma: Solitary or Extramedullary

- What Is The Dance Of Entanglement?

- What Is The Cheapest Postage To France?

- What Is The Aircraft Design Process?

- What Is The Difference Between Lager And Ale?

- What Is Swimming In _ Adult Swimming Lessons Near Draper, UT

- What Is The Difference Between A Garand