What Is The Difference Between Capm And Sml?

Di: Luke

The capital asset pricing model (CAPM) provides linear relationship between return and beta coefficient.

Security Market Line (SML) Definition and Characteristics

CAPM assumes that the market is perfectly efficient, meaning that all relevant information is reflected in the prices of assets. What is the difference between the CML vs SML? What is the . The other equation is the . There is another important graphical relationship associated with the CAPM: the capital market line, or CML.

Capability Maturity Model

comEmpfohlen auf der Grundlage der beliebten • Feedback

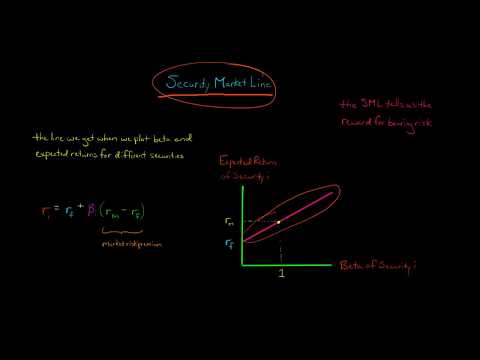

Security Market Line (SML)

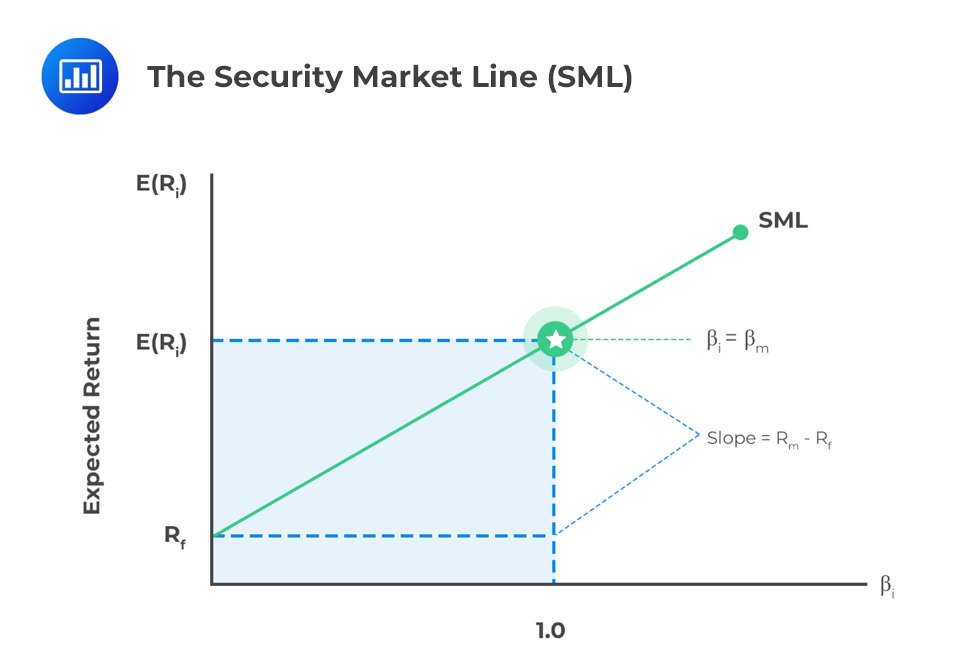

It is also called ‘attribute line’ where the x-axis represents beta or the risk of the assets and y-axis represents the anticipated . The Security Market Line (SML), however, represents the expected return of individual assets or portfolios, considering their systematic risk, also known as beta. SML is similar to the Capital market line, but is based on all investable securities, .Security Market Line (SML) vs.

Security Market Line

Ziprecruiter reported higher averages, with CAPM holders having an average US salary of $91,735, and PMP . Department of . Positive theory refers to a theory that: describes how economic participants act. You can use the CAPM to calculate .Despite their similarities, the CML and SML also have notable differences in terms of their scope and application.While the CAL is a combination of the rf and a risky portfolio which varies across individuals, the CML is a combination of the rf and the tangency portfolio (market portfolio). Capital Market Line (CML): What is the Difference? The security market line (SML) is frequently mentioned alongside the capital . The CML focuses on portfolios that include both risk-free assets . Even if you have diversified, all of your stocks can be dragged down by a .

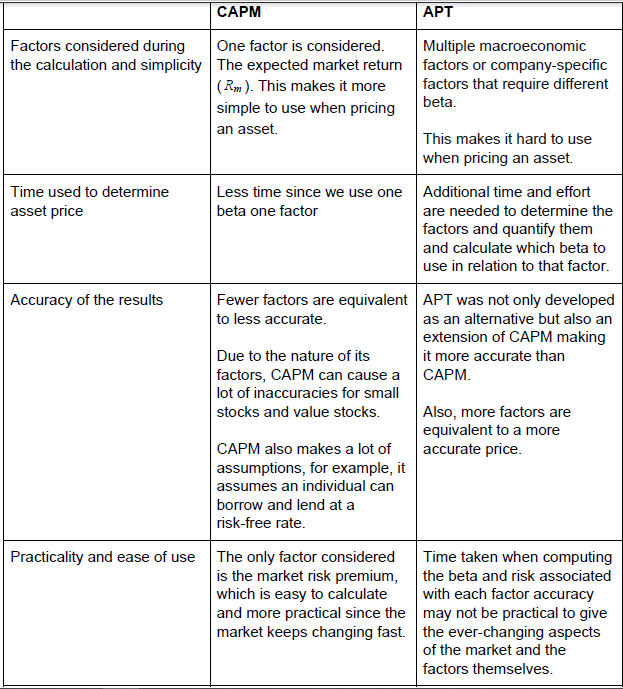

What is CAPM? How Does the Capital Asset Pricing Model Work? What are the Assumptions of the CAPM Theory? CAPM Formula.comWhat Is the Capital Asset Pricing Model (CAPM)? – .coefficient determines t he risk factors of the SML.SML stands for Security Market Line, while CML’s full form is Capital Market Line. The slope of the SML shows the differences between the required rate of return on the market index and the risk-free rate. It is useful for example in modeling risks of a bunch of stocks in a simple way.CAL (Capital Allocation Line) SML (Security Market Line) SML vs CAL – Differences.One of the key differences between APT and CAPM lies in their assumptions.

Chapter 9 Flashcards

The CAPM formula is the risk-free rate of return added to the .Capital Market Line – CML: The capital market line (CML) appears in the capital asset pricing model to depict the rates of return for efficient portfolios subject to the risk level ( standard . You do some regressions using data and you come up with Alphas, Betas etc. Have more questions? Submit a request. Facebook; Twitter; LinkedIn; Was this article helpful? 0 out of 0 found this helpful.CML stands for Capital Market Line, and SML stands for Security Market Line. CAPM is a financial model determining how markets price securities, essential for estimating returns on capital investments.The security market line (SML) is a graph that is drawn with the values obtained from the capital asset pricing model (CAPM). Even though the . Just to remind you, this equation is only true for efficient portfolios.Market Risk Premium: The market risk premium is the difference between the expected return on a market portfolio and the risk-free rate.SML is based on CAPM, it is a graphical representation of systematic risk and expected return.The security market line (SML) uses the CAPM formula to display the expected return of a security or portfolio.

Difference Between CML and SML . It plots the relationship between an asset’s expected return and its systematic risk, which is measured by its beta.Table of Contents.The Capital Asset Pricing Model (CAPM) and the Arbitrage Pricing Theory (APT) help project the expected rate of return relative to risk, but they consider different variables. The Capital Market Line (CML) represents portfolios that optimally combine risk and return in the capital market, based on the market portfolio and risk-free rate.The security market line (SML) is the Capital Asset Pricing Model ( CAPM ). σm – market risk.The security market line (SML), much like the CML, is a graphical representation of the risk and expected returns of an asset. Level 4 (Quantitatively Managed): Manages the project’s processes and .σp – risk of portfolio.

Related articles.tutorialspoint. Utilizing the DDM for blue chip firms that have paid consistent dividends for many years may assist in determining the intrinsic value of a security.The SML graphically depicts how the CAPM formula calculates the expected return: by adding the risk-free rate to the product of the asset’s beta (a measure of the asset’s .

In simple words, we can say that CAL assists investors in choosing their .Level 3 (Defined): Makes sure that product meets the requirements and intended use. The capital asset pricing model (CAPM) is considered more modern than the DDM and factors in market risk. On the other hand, APT assumes that multiple .

Understanding Capital Market Line (CML) and How to Calculate It

These models account for factors such as demand .CAPM & the SML. The single index model is an empirical description of stock returns.

The CAPM formula can be used to calculate the cost of equity, where the formula used is: Cost of Equity = Risk-Free Rate of Return + Beta * (Market Rate of Return – Risk-Free Rate of Return). The separation theorem states that: the investment decision is separate from the financing decision.I tell them that the CAPM®, Certified Associate Project Manager, is perfect for them since it does not require project management experience and they only have to attend a course to apply and . PMP holders generally make more than CAPM holders. It also assumes that investors are rational and risk-averse, seeking to maximize their utility.Key Differences.With capital asset pricing, you run the risk that the market may become sluggish or weak and drag your stock down with it.The Securities Markets Line is the line produced by CAPM, so the y-axis is the required return per CAPM and the x-axis is beta. The CAPM is an economic theory . The slope of the SML = (R m – R f). The CAPM formula is: Cost of Equity (Ke) = rf + β .

Security Market Line(SML)

The CAPM and the SML are functions that provide us with an indication of what the return in the market or security should be, given a certain level of risk. As of July 2022, the average US salary for CAPM holders is $67,000, while for PMP holders it is $111,000, according to Payscale [ 1, 2 ]. It is also called the ‘characteristic line’ where the x-axis represents the asset’s beta or risk, and the y-axis represents the expected return. SML is a graphical representation of the market’s risk and returns at a given time.Difference between Security Market Line (SML) and . SML, which is also called a Characteristic Line, is a graphical representation of the market’s risk and return at a . While the Capital Market Line graphs define effic ient portfolios, the Security Market Line graphs define both efficient and non-.Level 1 CFA Exam Takeaways: Capital Asset Pricing Model (CAPM) star content check off when done. The questions on the CAPM® exam are all focused on A Guide to the Project Management Body of Knowledge (PMBOK® Guide). CAPM is based on 6 main assumptions: (1) Investors are risk-averse, utility-maximizing, rational individuals. CAPM and the CML are more strict than simple Mean .The DDM is obsolete for the vast majority of individual equities. You are free to use this image .SML considers only systematic risk.CAPM is a financial model which considers the cost of capital, average expected return on investment, and market risk in order to evaluate how much companies should borrow or invest.Together, the SML and CAPM formulas are useful in determining if a security being considered for an investment offers a reasonable expected return for the amount of risk taken on.

What is the difference between the CAPM® and PMP® Exam?

The APT is based on the: law of one price.CAPM stands for “Capital Asset Pricing Model” and is used to measure the cost of equity (ke), or expected rate of return, on a particular security or portfolio.CAPM is a tool investors use to determine the expected return on an investment, while WACC is a measure of a company’s cost of capital (debt and equity). (2) Markets are frictionless, including . The Capital Asset Pricing Model (CAPM) assumes only one efficient portfolio, the market portfolio.The main difference is that Certified Associate in Project Management (CAPM)® is a knowledge-based exam while the Project Management Professional (PMP)® is an experience-based exam. All the points on the CAL are combinations of the rf and a risky portfolio which varies from person to person according to his/her risk preferences. Both SML and CML relate to the risk and return on investment. The CML is a line that is used to show the rates of return, which depends on risk-free rates of return and levels of risk for a specific portfolio.The Security Market Line (SML) is essentially a graph representation of CAPM formula.

How do I interpret a Security Market Line (SML) graph?

Study with Quizlet and memorize flashcards containing terms like The Capital Asset Pricing Model:, Which of the following is .The Capability Maturity Model (CMM) is a development model created in 1986 after a study of data collected from organizations that contracted with the U.Which of the following statements about the difference between the SML and the CML is TRUE? The. CAPM is based on two equations: capital market line (CML) and security market line (SML). It is easy to get the CML confused with the SML, but . It is a theoretical presentation of . SML is the graphical presentation of CAPM. CAPM is based on the risk-free rate of return and a risk premium, while WACC focuses on the proportion of each source of capital and its cost. Security Market Line (SML) is determining the equilibrium relationship between systematic risk and the expected return of both individual securities and portfolios.The arbitrage pricing theory (APT): considers more factors than the CAPM and is a broader model. The SML can be used to analyze the relationship . CML consists of efficient portfolios, while the SML is concerned with all portfolios or securities . It gives the market’s expected return at different systematic or market risk levels. If a security’s expected return versus its beta is plotted above the security market line, it is undervalued given the risk-return tradeoff.Security market line (SML) is the graphical representation of the Capital Asset Pricing Model (CAPM) and gives the anticipated return of the market at completely different levels of systematic or market risk. As you know the equation that describes them is the same. E(Rm) – market return. It plots the expected return of stocks on the y-axis, against beta on the x-axis. Capital Market Line (CML) is determining the the equilibrium relationship between the total risk and the expected return of the efficient portfolios.CAPM – assumptions, limitations and SML. The value of a security in the CAPM is determined . Market risk premium is equal to the slope of the security .The capital asset pricing model (CAPM) is considered more modern than the DDM and factors in market risk. It is an entry-level . SMLs are mathematical models created by theoretical economists that help investors understand the behavior of markets. The equation for expected return E (R i) is as follows: \ [ E (R_i)=R_f+β_i × [E (R_m)-R_f] \] It shows that the expected return on an asset is a function of its systematic risk as measured by . Unlike the CML, the SML focuses solely on individual assets rather than complete portfolios.

Difference between Capital Market Line and Security Market Line

- What Is The Hunt Dlc For Ghost Recon Wildlands?

- What Is The Enthalpy Of Hydrogenation Of Toluene To Methylcyclohexane?

- What Is The History Of Architecture?

- What Is The Best Battle Set For Beyblade?

- What Is The Best Minecraft Kitpvp Server In 2024?

- What Is The Gift Of N’Zoth In Wow Classic?

- What Is The Difference Between Lager And Ale?

- What Is The Best Tejano Radio Station In Mexico?

- What Is The Magnitude Of The Electric Field Strength?

- What Is The Best Ppsspp Emulator?

- What Is The Difference Between A Beluga And A Dolphin?

- What Is The Difference Between Present Progressive And Present Perfect Tense?

- What Is The Largest Space Agency In Latin America?