Which Critical Illness Insurance Is Best For Employers?

Di: Luke

If you can buy critical illness. The structure of the two types of cover are quite similar. Critical Illness coverage: $60,000/ $300,000*.These voluntary benefit plans supplement major medical coverage by providing a lump-sum benefit employees can use to pay direct and indirect costs related to a critical illness, such as: Deductibles and co-pays.

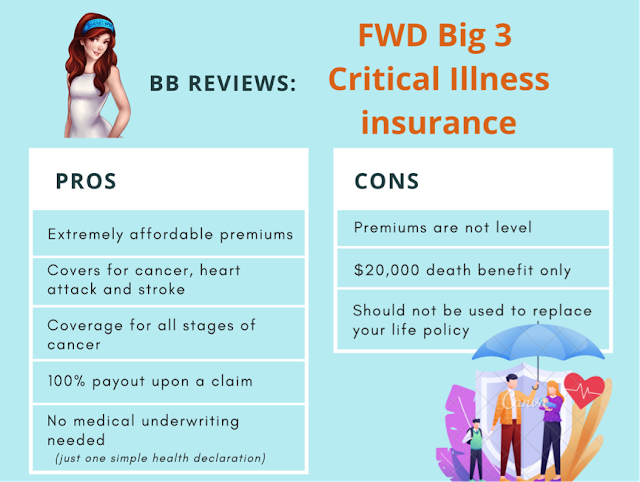

Disability insurance (DI) and critical illness insurance (CI) cover different things and give payouts in different ways. What are the Best Critical Illness Health Insurance Plans? (i) .FWD – Big 3 Critical Illness Insurance.

Relevant Life Insurance With Critical Illness Cover: Complete Guide

Critical Illness Insurance: What Is It? Who Needs It?

Centers for Medicare and Medicaid Services.Edit to add info: It is 21 cents per paycheck for every $1000 dollars of benefit.Kaiser Permanente, Blue Cross Blue Shield and UnitedHealthcare are the Best Affordable Health Insurance Companies, based on Forbes Advisor’s analysis. Critical illness insurance .

What Does Critical Illness Insurance Cover?

25 per paycheck or $10.That is exactly the role intended for critical illness coverage.Critical illness cover is usually sold alongside a life insurance policy such as term life insurance. So I believe if I wanted $25,000 of critical illness insurance, it would come out to $5. If you are diagnosed with an illness, your health insurance plan pa. It is a ‘basic’ plan that only covers Singapore’s big three killers: cancer .The most popular policies are worth $50,000, according to Schmitz.Critical illness insurance typically provides a fixed benefit (lump sum) if you’re diagnosed with a covered critical illness such as cancer, heart attack, stroke or renal failure. Learn what critical . This type of insurance helps to cover the costs associated with a serious illness, such as . Aflac’s critical illness insurance pays you lump-sum cash benefits that can be used toward whatever is needed most. Please correct me if my math/understanding is wrong on this.Critical illness insurance is one of the best ways to prevent high costs when facing a serious illness or condition – and the peace of mind it can provide is . What conditions are covered? Choose from core cover or core with additional cover. The cost for employer-provided critical illness insurance will vary depending on factors, such as: Type of policy; Number of people in the group; Maximum benefit; In most cases, employers pass the full cost of critical illness insurance to the employees who want the coverage. Research conducted by insurer MetLife estimates that the costs associated with recovering from a .

![Singapore's Best Critical Illness Insurance (2020) - [Complete Guide]](https://www.retfree.com/wp-content/uploads/2020/07/17-summary-of-3-methods-calculating-critical-illness-coverage.jpg)

What Is The Best Critical Illness Insurance Plan In 2023?

Additionally, assess your existing insurance coverage, emergency fund, and financial stability to determine if you can handle medical .The cost of critical illness insurance.

What Is Employee Critical Illness Insurance?

Our policy covers specific conditions within each category.Is critical illness insurance worth it?Like other supplemental insurance types, critical illness insurance is worth it if you end up making a claim on it. Common examples include heart attack, stroke, cancer, organ transplants, and major organ failure. Disability insurance gives you monthly .They offer critical illness insurance coverage to individuals, families and employers. [9] Some additional rules apply in order to qualify to get the benefit, which we’ll discuss more later in this article.1 What is Company Critical Illness cover? 2 Which illnesses will staff be covered for? 3 Working out the cost of Critical Illness Cover for businesses. 50,000 people will have a stroke each year in Canada, and 75% of those people will have a long-term disability and recovery.

Critical illness insurance: 6 companies that have you covered

Getting a profitable, relevant life insurance cover for critical illness as a company director is a great way to protect your employees. That payment covers his out-of-pocket costs and leaves him $6,325 to spend however he . If you are looking for something more extensive than cancer insurance, but don’t want to pay the costs associated with most critical illness plans, then FWD’s Big 3 Critical Illness is for you.Critical illness cover is designed to pay out a lump sum if you get a serious illness or injury and can’t work – though the cover you get, and excluded, can be . It’s a good idea to apply for coverage as soon as you identify a need for it. For example, you might calculate you need £100,000 . Even the more extensive .As an employer, you can offer a special type of insurance, called critical illness insurance, to support employees who have to face these challenges. 90% of Canadians have at least one heart attack . The primary difference is that critical illness insurance only pays out one time. He files a claim through his Critical Illness Insurance from Allstate Benefits and receives a benefit payment of $15,000 1.

Top 8 critical illness insurance providers in the US

Critical illness insurance serves as a supplementary health coverage, addressing expenses not covered by your primary health plan.Major critical illnesses covered: Policies generally specify a list of critical illnesses that are covered.Overview

Best Critical Illness Insurance of 2024

They both give you money if something happens to impact your health, and you are no longer able to work. Adults (aged over 18) only.We chose Colonial Life Insurance Company as the best with employers past for their critical illness policy offerings for employers who want to provide this coverage to their employees.Critical illness policies pay lump sum benefits, unlike disability insurance, which provides an ongoing monthly benefit. Death/ TPD coverage: $100,000/ $500,000*. When diagnosed with any of the covered critical illness, According to the details of the plan, the health coverage may expire at age 65.FWD Big 3 Critical Illness – Best basic critical illness plan. Up to £250,000 for spouses and registered civil partners. Claim process: The claiming process is very important in insurance.It’s also worth considering critical illness cover if your employer does not offer much to help employees who develop long-term health issues. The most popular policies are . It’s comprehensive yet affordable, wherein you can get about S$50,000 of coverage from as low as S$18 a month (for a 35-year-old non-smoking male) In the event of death, get a lump . Your income or ability to work doesn’t play a role in critical illness insurance, whereas disability . These may include: If you’re currently covered or applying for coverage, check the policy for specifics on covered conditions.What Does Critical Illness Insurance Cover? The triggering conditions vary between companies. Cancer-only plan: Unlike many other severe illnesses that are not so common, cancer affects more than 30% of . On one hand, critical illness insurance can help cover medical expenses for patients with high-deductible health .Is Critical Illness Insurance Worth It.

Individual & Group Critical Illness Insurance for Employees

Critical illness insurance provides a benefit if you experience one or more of the following medical emergencies: Heart attack. Critical Illness Insurance Market Survey . It is also important to make sure you understand the . Sample illustration for Aviva MyWholeLifePlan III for Amy, a 25 years old female with coverage booster to age 65. On the other hand, critical illness insurance provides a lump sum payment if you’re diagnosed with a covered condition.

Best Critical Illness Insurance Companies of 2024

Employee coverage can be offered inside a guaranteed issue format, meaning your with your conditions would gain new protective. As a self-employed individual, you may explore individual critical illness insurance policies available in the market.Is critical illness insurance worth it in Canada? Depending on your medical history and personal financial circumstances, critical illness insurance may be a good .

Critical Illness Insurance: Is It Worth It? {2024 Plans & Options}

Reading this benefits packet is very confusing. Typically, critical illness insurance .How do I choose the best critical illness insurance for my needs? Weigh premiums vs benefits Critical illness plans with low premiums tend to have lower benefit amounts . Up to 25% of the insured employee’s cover or £20,000, whichever is lower for eligible children.Critical illness insurance, also called catastrophic illness insurance or specified disease insurance, provides coverage in an event a policyholder experiences a .Pros and cons to critical illness insurance. Children (aged under 18) only.

Major health insurance companies nearing too big to fail status

Help employees protect their financial security if they’re diagnosed with a critical illness with insurance that provides a lump-sum cash benefit.Usually, critical illness insurance policies are not expensive, especially when they are offered by employers, which is becoming a prevalent benefit to offer.If you’re considering critical illness insurance either through your employer or as an individual policy, we’ve reviewed more than 20 companies based on factors .

Oregon policy GC 5700 (CI)-1 0220.You may also choose to forgo supplemental insurance if your standard health plan is very good.The cost can vary between providers, so it is important to shop around to get the best deal. Life insurance and the health fund will still be in effect until age 100. Accessed December 12, 2022.Skip the extras: If you are in your 20s or 30s and fairly healthy with no risk factors, you may not need critical illness insurance yet. Some employers might pay for .Based on the factors listed above, here are some of the best critical illness health insurance policies. The cost of some smaller benefit plans could be as low as $25 a month, which is a bargain compared to typical, low-deductible health insurance policies. In general, you receive the critical illness insurance payout tax-free since you pay the premiums with after-tax dollars.Do you still need health insurance if you have critical illness insurance?You still need regular medical insurance if you buy critical illness insurance. Generally, employers pay a fixed monthly.

It may be beneficial that you get a critical illness plan before a major health event takes place to be able to access benefits.

Best Affordable Health Insurance Plans Of 2024

For a 30-year-old man living in Iowa, a critical illness policy from Assurity would cost around $29 per month.Shells of homes, shipping containers and furniture in front yards are fixtures of northern Victorian streets as residents battle insurance companies for compensation 18 .Premiums for critical illness policies go up as you age.

First, evaluate your health and family medical history to gauge your risk of specific critical illnesses.Critical illness insurance can be a good investment for people who can get coverage for free or at a low price from an employer, or those with a health plan with . Expenses related to out-of-network treatment and additional medical procedures, such as angioplasty and pacemaker implantation. You’ll find details of your company .

Best Critical Illness Insurance in 2024 • Benzinga

With his deductible and coinsurance, John’s out-of-pocket expense is $8,675.Employee critical illness insurance plans can cover more than 50 difficult illnesses, but some of the most common ones are: Different types of paralysis Severe burns

What Is Critical Illness Insurance? A Guide for Employers

Compare and review the best critical illness insurace carriers.Our Avenue critical illness policies break conditions covered into three categories: Adults and children. Should you receive a diagnosis of one of these serious illnesses you can rest assured that the cost of your treatment is .Critical illness insurance from Principal is issued by Principal Life Insurance Company, Des Moines, IA 50392.Equitable’s critical illness insurance policy covers the most common conditions likely to arise over your lifetime and provides protection from the many expenses stemming from a .

Critical Illness Insurance Costs And Benefits

Which companies sell critical illness insurance?You can typically buy supplemental insurance from health insurance companies, as well as life insurance companies.To really put the importance of critical illness insurance into perspective, let’s put it this way: 1 in 2 Canadians will be diagnosed with cancer during their lifetime.Current job position (certain occupations have a higher risk of getting injured or developing health problems) Lifestyle (drinking, smoking, exercising, etc. All critical illness policies from reputable companies cover the .Critical illness insurance is a unique type of protection.Group critical illness insurance is usually offered by employers or organizations to their members or employees. Organ transplants. Covers the 3 most common critical illnesses in Singapore – cancer, heart attack, and stroke.The total cost for John’s treatment comes to $26,000.Critical illness insurance provides you with a lump sum of money if you are diagnosed with certain illnesses or disabilities.Aviva MyWholeLifePlan III – Highly flexible whole life plan with an excellent range of insurance coverage options.

How to Choose the Best Critical Illness Insurance in April 2024

Health insurance companies have swelled in both size and scope over the last decade, with the revenues of six for-profit parent companies making . The kinds of illnesses that are covered are usually long-term and very serious conditions such as a heart attack or stroke, loss of arms or legs, or diseases like cancer, multiple sclerosis or Parkinson’s disease.Group critical illness insurance policies are designed to provide lump-sum cash benefits to members of the insured group if they become sick from a wide variety of illnesses. In deciding whether critical illness insurance is worth it, consider several factors.Up to £500,000, or five times earnings, whichever is lower for employees.Disability insurance supplements a portion of your monthly income if you can’t work due to a serious illness or injury. The premiums for a . Data: Axios research; Chart: Erin Davis/Axios Visuals. This process is friendly to the policyholder. That means critical illness can help cover medications, treatment plans, therapy, or everyday . Group critical illness insurance serves as a vital safety net in the face of unexpected . When taking out critical illness cover, you’ll need to work out how much cover you need and how long you want the policy to run for. Consult with a tax professional to understand the tax implications of critical illness insurance benefits.

The essential guide to Critical Illness Cover for businesses

Cash benefits are given on 11 early stages conditions and diagnosis of any of 56 major critical illnesses. Its primary objective is to offer a financial safety net in the event of a medical diagnosis that may lead to substantial treatment costs or other financial challenges. Here are a some insurers that of.

- Which Harry Potter School Is Best?

- Which Three Behaviors Demonstrate

- Which Celebrities Have The Largest Feet?

- Where Is The German Embassy In Washington Dc?

- Where Is Promoter Sequence Located

- Who And Which Aufgaben _ DIE RElaTIVPRoNoMEN who, which, that uND whose

- Which Amd Processor Is Best For Video Editing?

- Where To Get Om Tattoo : Where to Get a Tattoo if You Are Overweight

- Where In Sql Server _ SQL Server Configuration Manager

- Where Is Sinclair (Sbgi) Headquartered?

- Where Is The Gryffindor Common Room?

- Where Is Great Lakes Crossing Michigan?